Understanding the Differences in Disability Definitions

When purchasing a disability insurance policy, one of the most important aspects to understand is how the term “disability” is defined. This definition forms the basis of when benefits are payable and what criteria you must meet to qualify for those benefits. Different policies use various definitions of disability, and these distinctions can have significant implications for your coverage, the duration of benefits, and the overall value of your policy.

Key Definitions of Disability in Insurance Policies

1. Own Occupation (Own Occ) Disability

Definition: Under an “own occupation” definition, you are considered disabled if you are unable to perform the substantial and material duties of your specific occupation.

Implications: This is generally considered the most favorable definition for the policyholder. If your policy has an own-occupation clause, you could still receive benefits even if you are able to work in a different job or capacity, as long as you cannot perform your original occupation. For example, a surgeon who develops a hand tremor and can no longer operate may qualify for benefits under an “own occupation” policy, even if they could work in a non-surgical medical role.

2. Any Occupation (Any Occ) Disability

Definition: Under an “any occupation” definition, you are considered disabled only if you are unable to perform the duties of any job for which you are reasonably suited by education, training, or experience.

Implications: This definition is more restrictive than the “own occupation” definition. To qualify for benefits, you must prove that you cannot perform any job that fits your skill set and training. The insurer may determine that you are not disabled if there is another job you can do, even if it’s not your original occupation. For example, a software engineer who is unable to code due to an injury might not qualify for benefits if they can perform another type of work, such as teaching or consulting.

3. Modified Own Occupation Disability

Definition: This definition is a hybrid between “own occupation” and “any occupation.” It typically considers you disabled if you are unable to perform your own occupation and are not working in any other occupation.

Implications: While you are covered if you cannot perform your own job, you would lose benefits if you take up any new employment, even if it is outside your original field. This can be less favorable than a pure “own occupation” policy but more flexible than an “any occupation” policy.

4. Transitional Own Occupation Disability

- Definition: Under this definition, you are considered disabled if you cannot perform your original occupation, but the benefits you receive are offset by any income you earn from another job.

Implications: This allows you to return to work in a different capacity while still receiving partial benefits, making it a middle ground between “own occupation” and “any occupation” policies. However, the total amount of benefits may decrease as your new income increases.

5. Partial Disability

Definition: A partial disability definition applies if you are still able to work but are unable to perform some of the duties of your occupation or can only work part-time due to illness or injury.

Implications: This type of coverage typically pays a portion of the benefit if you experience a loss of income due to being partially disabled. For example, if you can only work 20 hours a week instead of your normal 40 hours, a partial disability benefit might compensate you for the income lost due to reduced hours.

6. Residual Disability

Definition: Residual disability coverage is similar to partial disability but focuses on income loss rather than the specific duties you can perform. It pays benefits based on the percentage of income lost due to a disability.

Implications: This type of definition is useful if you are still able to work in some capacity but experience a significant reduction in income. For example, if you lose 50% of your income due to a disability, the policy would pay a corresponding percentage of your total benefit amount.

7. Presumptive Disability

Definition: Presumptive disability automatically considers you disabled if you suffer from specific severe conditions, such as the loss of sight, hearing, speech, or use of limbs, regardless of your ability to work.

Implications: This is a highly favorable definition for severe disabilities, as it guarantees benefits without requiring further proof that you cannot perform your occupation or any occupation. It is designed for the most catastrophic situations where the disability is unquestionable.

Why Understanding These Disability Definitions Matters

- Claim Approval: The more restrictive the definition, the harder it will be to qualify for benefits. A policy with an “own occupation” definition provides a higher chance of claim approval than an “any occupation” policy.

- Cost of Premiums: Policies with more favorable definitions, like “own occupation,” tend to have higher premiums because they offer broader coverage. Less favorable definitions often come with lower premiums but could leave you without benefits when you need them most.

- Financial Security: The right definition of disability ensures that you receive adequate financial protection tailored to your occupation, lifestyle, and risk tolerance.

Conclusion

When selecting a disability insurance policy, carefully review the definitions of disability to ensure it aligns with your needs and circumstances. Each definition offers different levels of protection and has unique implications for how and when benefits are paid. By understanding these differences, you can make a more informed decision and choose a policy that provides the best possible coverage for you and your family.

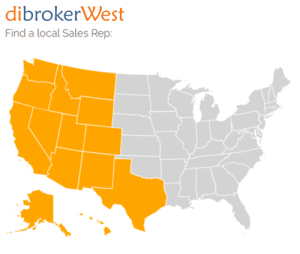

For more information about disability income insurance with mental nervous disorders, please call your local Regional Sales Reps for details!