Why Doctors Need Disability Income Insurance

For your clients who are doctors, their ability to earn a living hinges on one crucial factor: their health. After years of education and training, a doctor’s skills are not just their livelihood—they’re a significant financial investment. But what happens if an injury or illness prevents your doctor client from working? That’s where disability insurance comes in, offering a financial safety net when life takes an unexpected turn.

Here’s why every doctor should prioritize disability insurance and what they should look for when choosing the right policy.

Why Disability Insurance Is Essential for Doctors

- A Doctors Income Drives Their Lifestyle and Future Goals

Doctors often have high earning potential but they also face unique financial pressures, such as significant student debt, higher living costs and the expectation of maintaining a certain lifestyle. Losing their income due to a disability could derail their financial goals, from retirement savings to supporting their family.

- Medical Professions Have Physical and Mental Risks

Doctors face repetitive stress injuries, mental health challenges like burnout and potential exposure to infectious diseases. A disability doesn’t have to be catastrophic to disrupt a medical career—it could be as simple as a hand injury that prevents a surgeon from operating. Disability income insurance with the correct provisions can protect a doctor’s income.

- Your Clients Specialty May Not Be Easily Transferrable

If your client is trained in a highly specialized field, like cardiology, oncology, etc., transitioning to a different role within medicine after a disability might not be feasible. A doctor who is highly specialized might be able to find another role in the medical field following a disability, however chances are the income would be lower and a compensation level that the doctor may not be willing to accept. Specialty-specific disability insurance also exists and can help bridge this gap.

- Social Security and Employer Coverage May Not Be Enough

Employer-provided disability insurance is often limited, with caps on coverage that may not align with your client’s salary. Additionally, Social Security Disability Insurance (SSDI) has strict qualifications and typically offers lower payouts than private policies.

Key Features Doctors Should Look for in Disability Insurance

- Own-Occupation Coverage

This is one of the most critical disability insurance features for doctors. Own-occupation policies pay benefits if your client cannot perform the specific duties of their specialty, even if they’re able to work in another capacity. For instance, a surgeon who can no longer operate but can teach would still qualify to receive disability benefits. - Residual Disability Benefits

Sometimes, a disability may reduce your client’s ability to work full-time without completely preventing them from practicing. Residual benefits compensate for partial income loss, ensuring financial stability during recovery or adaptation.

- Non-Cancelable and Guaranteed Renewable Policies

Look for policies that cannot be canceled by the insurer. Many disability insurance policies have provisions that if you continually pay premiums, the policy can’t be canceled. This ensures your clients’ rates won’t increase and their policy terms remain stable.

- Disability Insurance Cost-of-Living Adjustments (COLA)

COLA riders adjust the benefit amount to address inflation, ensuring that the purchasing power of their payouts remains consistent over time. Each insurance company that we work with has different guidelines for calculating COLA but the advantage for clients to increase their benefit amount – without additional underwriting – can be a game changer.

- Future Increase Option

Future increase option provisions are a vital feature for doctors, especially early in their careers. Doctors have substantial salary increase opportunities throughout their career. Future increase options (AKA benefit increase riders, automatic increase riders, etc.) allow doctors to increase their coverage as their income grows, without undergoing additional medical underwriting.

- Waiting Period and Benefit Period

The waiting period (or elimination period) is the time you must wait after becoming disabled before benefits start. Clients should choose a waiting period that aligns with their savings. A longer waiting period can lower the amount a client pays for the policy. This could be a good option if a client has enough savings to cover expenses during the waiting period. The benefit period should ideally last until retirement age.

Tips for Selecting the Right Disability Insurance Policy

Work with a Specialist Broker: Disability insurance policies are complex. A broker who specializes in policies for physicians can help you navigate the options.

Start Early: Premiums are lower when you’re younger and healthier. Lock in coverage before any health issues arise.

Assess Your Clients’ Budget: While comprehensive coverage is ideal, any policy is better than none. Work within your budget to get the best coverage you can afford.

Review Group Coverage: If your employer offers a group policy, understand its limitations and consider supplementing it with an individual plan.

Read the Fine Print: Understand what constitutes a “disability” under your policy and be aware of any exclusions.

Final Thoughts

Disability insurance isn’t just a safety net—it’s a vital component of financial planning for doctors. By securing the right policy, you’re safeguarding your client’s income, their family’s future and the years of dedication they’ve poured into their career. Think of it as an investment in your client’s peace of mind, ensuring that even if the unexpected happens, financial stability remains intact.

If you have a doctor client who is considering disability insurance, don’t wait for a health scare to make it a priority. Doctors should start researching and consulting a trusted partner to protect their ability to earn an income.

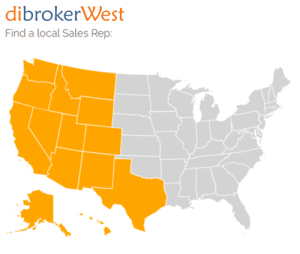

For more information about disability income insurance for doctors – or any disability income insurance questions, please call your local Regional Sales Reps for more info!