10-Steps to File a Disability Income Insurance Claim

No one ever wants to file a disability insurance claim. However, having the proper income protection before you need it will offer peace of mind at claim time. Filing a disability income insurance claim can seem daunting but with the right information and preparation, the process can be manageable. Here’s a comprehensive guide to help you navigate through the steps needed to file your claim effectively.

Step 1: Contact Your Agent

Before you start the claim process, you should contact the insurance agent or financial advisor who sold you the process. Chances are that person will have experience in filing claims and can offer helpful advice, including what to do first, who to contact and what to say. Also, each insurance company has a unique claims process and mistakes following their process may delay or affect your coverage.

Step 2: Review Your Policy

Your disability income insurance policy is your contract with the insurance company. It clearly outlines the terms and conditions, the definition of disability according to your policy, the waiting period before benefits begin, the duration of benefits and much more. You must understand the details of your coverage and the specific requirements and documentation needed for a claim.

Step 3: Notify Your Employer

If your disability income insurance is provided through your employer, notify them about your condition as soon as possible. They will guide you on how to proceed with the claim and may have specific forms or processes that you need to follow. If you have an individual policy, contact your insurance provider directly.

Step 4: Gather Necessary Documentation

Prepare all the necessary documentation to support your claim. This typically includes:

- Medical Records: Detailed records from your healthcare provider that document your condition, diagnosis and treatment.

- Doctor’s Statement: A statement from your physician confirming your disability and the expected duration of your inability to work.

- Employment Records: Proof of employment and income, such as pay stubs, tax returns or a letter from your employer.

- Insurance Forms: Any forms required by your insurance company, which may include a claim form and an attending physician’s statement.

Step 5: Complete the Claim Form

Fill out the claim form provided by your insurance company. Ensure all sections are completed accurately and truthfully. Incomplete or incorrect information can delay the processing of your claim. If you need assistance, contact your insurance provider or a legal advisor.

Step 6: Submit Your Claim

Once you have gathered all the necessary documentation and completed the claim form, submit your claim to your insurance company. This can often be done online, by mail or through your employer if the policy is an employer-provided benefit. Keep copies of all documents for your records.

Step 7: Follow Up

After submitting your claim, follow up with your insurance company to ensure they have received all necessary information. Keep a record of all communications, including dates, names of representatives you speak with and details of the conversations. This can be useful if there are any issues or delays in processing your claim.

Step 8: Respond to Additional Requests

Your insurance company may request additional information or clarification during the review process. Respond promptly to any requests to avoid delays in the processing of your claim. Stay in regular contact with your healthcare provider to ensure they are also responding to any inquiries from the insurance company.

Step 9: Review the Decision

Once your claim is reviewed, the insurance company will notify you of their decision. If your claim is approved, review the details of the benefits, including the amount, payment schedule and any other terms. If your claim is denied, review the reasons for the denial and understand your rights to appeal the decision.

Step 10: Appeal if Necessary

If your claim is denied, you have the right to appeal the decision. Review your policy for the appeal process and gather any additional documentation that supports your claim. Consider seeking legal advice to strengthen your appeal and ensure you meet all deadlines.

Conclusion

Filing a disability income insurance claim requires careful preparation and attention to detail. By following these steps, you can navigate the process more effectively and increase your chances of a successful claim. Remember to stay organized, keep thorough records and seek assistance when needed. Your disability income insurance is there to provide support during challenging times, so make sure to utilize it to its full potential.

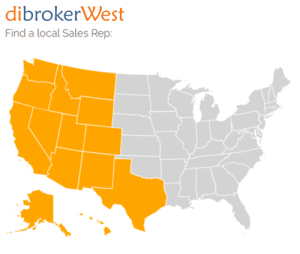

For more information about disability income insurance products from the carriers we work with, please call our diCoaches or your local Regional Sales Reps for details!