3 Big Mistakes Small Businesses Make with DI

Many small business owners have purchased disability income insurance to protect their salary. That’s great news! Having a personal disability insurance policy will replace part of your clients own income if he/she were unable to work due to an illness or injury. But, if that’s the only disability income insurance these clients have, they’re leaving their business open to a considerable amount of financial risk. There are several types of disability income insurance geared specifically for small business owners that could save your clients a lot of stress and economic headaches in the future.

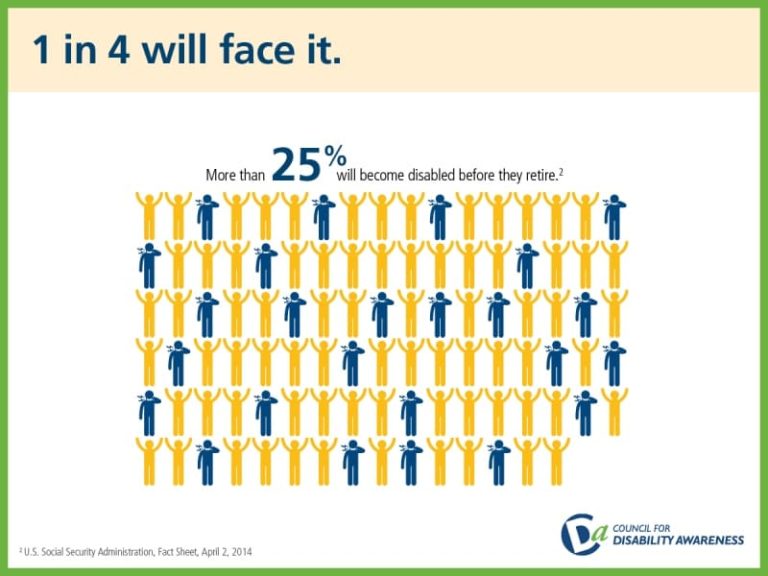

What’s the Likelihood of Illness or Injury?

1. Not Insuring a Key Person with Disability Insurance

Examples of Key Employees

- Accountants

- Architects

- Attorneys

- Brokers/Agents

- Chiropractors

- Civil Engineers

- Dentists

- Doctors

- Real Estate Agents

2. Not Covering Daily Business Operations with Overhead Expense Disability Insurance

3. Skipping a Buy/Sell Disability Insurance Policy

Selling Disability Insurance to Small Business Owners

What would happen if you developed an illness or injury that prevented you from performing your highly specialized dental procedures? How long would you be able to pay your personal bills – mortgage, utilities and put groceries on the table? Would you be able to continue paying the loan for your dental practice? What would the daily operation or your business look like? Would you be able to continue paying salaries for your staff?