4 Mistakes Clients Should Avoid When Buying DI

Selling disability income insurance can be challenging. Finding the right policy and plan design for your clients’ unique needs requires time, research and sometimes professional advice. Fortunately, you’ve made the right choice and you’ve come to the right place to learn more!

Disability insurance policies have many moving parts that affect price, coverage benefits and policy features. These moving parts often make polices very tough to compare. Here are the four most common errors your clients should avoid when shopping for disability income insurance.

Mistake #1: Not buying enough coverage

When it comes to buying any kind of insurance, people rarely overestimate how much they need. If there’s a mistake to be made in determining a coverage amount, most buyers of insurance — whether it’s life, property or disability — will buy too little.

It’s an easy mistake to make. After all, nobody really wants to buy insurance. Most believe they’ll never use it and don’t have extra money in their budget for complete coverage.

But buying too little disability insurance coverage today can cause major headaches if an injury or illness that impacts your clients’ ability to earn a paycheck does occur. Your client could easily lose half of their income or more between earnings before the disability and the amount the insurance benefits pay. The problem could be potentially compounded by any additional medical expenses caused by the disability.

When assessing your clients’ disability insurance needs, thoroughly consider:

- Their current and future income

- Their current and future living expenses

- Any increasing expenses resulting from a disability (e.g.—medical treatment)

- Any increasing cost of goods and services (i.e.—inflation)

Mistake #2: Relying solely on group or employer-provided coverage

Many people make the mistake of relying solely on group disability insurance they may have through their employer or a professional association. Group plans are cheaper than individual policies because the employer or association is paying either part or all the cost. Also, group coverage is easier than researching individual coverage because the employer or association has already done most of the leg work. Plus, since most people don’t anticipate ever becoming disabled, it’s easy to believe group insurance is more than enough.

Group policies are a good way of supplementing disability coverage but your clients should never rely solely on one. Doing so puts them at risk of:

- Losing coverage because of a job or membership status change

- Having the sponsor or insurer cancel the policy

- Only getting benefits that cover a fraction of pre-disability income

- Only getting benefits for a limited time frame

- Having limits on what is considered total disability

- Not having access to additional key features and benefits available on individual disability plans

- Paying taxes on the benefits you receive if he/she becomes disabled

An individual policy, on the other hand, is owned by the insured. It can therefore be tailored to their specific needs and lifestyle. This type of policy typically cannot be canceled and is guaranteed to renew, meaning the only way to lose coverage is to stop paying premiums.

Mistake #3: Not comparing disability income insurance options

Would you buy the first car you test drove? Or make an offer on the first house you walked through? Not likely. Most people spend time comparing multiple options – especially when considering more expensive items – before making a final decision.

The same should be true for disability insurance. While the cost of disability insurance doesn’t equate to the cost of a house or car, it’s a purchase many clients don’t consider often – or view as optional. Your client should never limit their search to one policy or recommendation. For every quote request we get, we typically provide more than one quote/proposal from the different companies we work with. Between the different carriers, we can also find a plan to suit your clients’ needs.

When presenting options, your client should always consider more than just cost. You should compare various contract provisions, benefits, waiting/elimination periods, features included in the base contract and any optional riders that may be offered.

Doing this without professional help could be a daunting task for most people, but we’re here to help! We’re experts in disability income insurance and we work with many different, top-rated companies. We’re ready to answer questions and coach you on the best way to present the product to your client.

Mistake #4: Not taking the time to understand all of your policy's provisions

The worst time to be surprised by what is — or isn’t — in your clients’ disability insurance policy is when it’s time to file a claim. Take the time to review the policy with your client before they sign the dotted line.

The policy details your client should absolutely understand include:

- How is disability defined – is it own occupation or any occupation?

- When can a client collect for residual or partial disability?

- Length of waiting period (AKA elimination period) – how long does your client have to wait before collecting benefits from the insurance company?

- Benefit length – if a client becomes disabled, how long will he/she receive benefits?

- Exclusions and limitations, including disabilities related to mental illness and anything that might come up during underwriting

- Future increase option – will your clients’ income be increasing in the future? Make sure clients can increase disability benefit amounts down the road to avoid gaps in income.

- Catastrophic benefit – does the policy include extra benefits for a severe disability that impacts daily activities?

- Cost-of-living adjustment on benefits – will benefits adjust each year to keep pace with inflation?

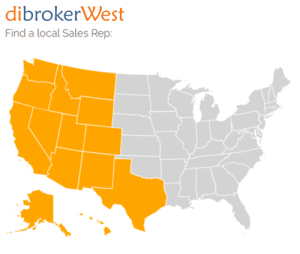

If you have any questions, don’t hesitate to give your Local Sales Rep a call!