Choosing the Right Business Overhead Expense Disability Insurance Policy

Business Overhead Expense (BOE) is a unique disability insurance product, focused on keeping a business open following a disability. Specifically, BOE covers a business’s operational expenses if a business owner is unable to work due to an illness or injury. When selecting a BOE insurance policy, it’s important for your client to carefully assess their business’s operating costs and risks. Some factors to consider include:

1. Assess the Monthly Overhead Costs for Your Clients Business

The first step in selecting a BOE insurance policy is to accurately assess the business’s regular overhead expenses. These are the costs that continue to accrue even if your client is unable to work. These expenses will form the basis of how much coverage your client needs. Consider including the following expenses:

- Rent or mortgage payments for the office, store or workspace

- Employee salaries (both full-time and part-time) and wages

- Utilities such as electricity, water, gas and internet

- Insurance premiums for other existing policies (e.g., property, liability and health insurance)

- Loan payments or lease obligations on business equipment

- Office supplies and any inventory costs

- Taxes and accounting fees

Once you have a clear understanding of your clients average monthly expenses, you’ll be better positioned to select a policy that provides sufficient coverage.

2. Understand the Waiting Period

BOE policies typically include a waiting (or elimination) period, which is the length of time your client must be disabled before the benefits start paying out. Common waiting periods range from 30- to 90-days.

When choosing a waiting period:

- Shorter waiting periods (e.g., 30-days) mean benefits will begin sooner but may come with higher premiums.

- Longer waiting periods (e.g., 60- or 90-days) generally result in lower premiums but your client will need to ensure the business has enough cash reserves to cover costs during this gap.

Consider the business’s cash flow and whether your client can afford to cover expenses for a longer waiting period before benefits kick in. If the business is more vulnerable to short-term cash flow disruptions, a shorter waiting period may be the better choice.

3. Determine the Coverage Period

The coverage period is the maximum amount of time the policy will pay benefits. Most BOE policies offer coverage for periods ranging from 12- to 24-months. The ideal coverage period for your client’s business will depend on factors such as:

- The nature of the disability and how long it might take to recover

- The complexity of business operations (i.e., if the absence of your client would require a long recovery and transition period)

- The resilience of the business, such as whether your client has backup management or partners who could step in during the absence

Selecting a longer coverage period can provide more comprehensive protection but it will also come with higher premiums. A 12-month coverage period is often sufficient for less complex businesses, while more intricate businesses may require up to 24-months.

4. Consider Policy Exclusions and Limitations

Like any insurance policy, BOE insurance has specific exclusions and limitations, which outline the circumstances under which coverage will not apply. Common exclusions may include:

- Disabilities resulting from pre-existing conditions

- Disabilities caused by self-inflicted injuries

- Disabilities resulting from criminal activities

Make sure to review these exclusions carefully, especially if your client has any existing health conditions that may affect their eligibility for coverage. It’s also essential to understand any limits on certain expense categories, such as maximum allowable coverage for employee wages or rent.

5. Look for Optional Riders

Some BOE insurance policies offer optional riders—add-ons that enhance the policy’s coverage or provide additional benefits. Riders can help you tailor the policy to your client’s specific business needs. Examples include:

- Residual disability rider: This provides partial benefits if your client is only partially disabled and can still work but at a reduced capacity. It can help cover a portion of overhead expenses while your client recovers and transitions back to full capacity.

- Future increase option: This allows the policy owner to increase their coverage in the future as the business grows, without requiring additional medical exams or underwriting.

- Cost of living adjustment (COLA) rider: This rider adjusts the benefit amount over time to account for inflation, ensuring that the coverage keeps pace with rising business expenses.

Evaluate whether any of these riders are beneficial based on your client’s specific business situation. For example, if the business is growing, the future increase option rider can be helpful to ensure

coverage remains adequate over time.

6. Compare Premiums and Deductibles

The premium is the cost your client will pay for the policy. It’s important to strike a balance between affordability and adequate coverage. When comparing premiums across different policies, consider the following factors that affect pricing:

- Coverage amount: Higher coverage limits will result in higher premiums.

- Waiting period: Shorter waiting periods typically come with higher premiums.

- Coverage period: Longer benefit periods (e.g., 24-months vs. 12-months) may increase your premium.

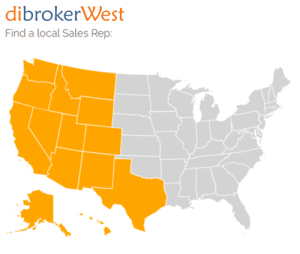

In some cases, insurers may offer discounts for bundling a BOE policy with other types of insurance, such as a personal disability or another business insurance policy. Be sure to ask your dibrokerWest Sales Rep if your client is eligible for any multi-policy or business-owner discounts.

7. Work with a Reputable Insurance Provider

Lastly, ensure that the insurer your client chooses has a strong reputation for reliability and customer service. It’s important to feel confident that the company will pay out benefits promptly if your client ever needs to file a claim. Look for:

- Strong financial ratings from independent agencies like AM Best or Standard & Poor’s

- Customer reviews or testimonials regarding the insurer’s claims process

- Agent expertise in business insurance to guide you through the selection process

Conclusion: Tailoring BOE Insurance to Your Clients Business

Choosing the right Business Overhead Expense Disability Insurance policy involves careful planning and a thorough understanding of your clients business’s financial structure. By assessing your clients overhead costs, understanding the policy’s terms and considering optional riders, you can help clients select a policy that offers the right level of protection.

Remember, investing in BOE insurance is about securing the future of your clients business and ensuring its survival even when unexpected challenges arise.

For more information about disability income insurance with mental nervous disorders, please call your local Regional Sales Reps for details! You can also connect with us on LinkedIn.