Disability Insurance Providers and E&O Insurance: Protecting Your Practice

Disability insurance is a vital safety net for individuals, offering income protection when illness or injury prevents them from working. Providers of disability insurance play a critical role in ensuring that clients receive the benefits they need when life takes an unexpected turn. However, the nature of this service comes with its own risks. Even with the best intentions, mistakes can happen—whether it’s a misunderstanding, an administrative error, or a failure to provide complete information.

This is where Errors and Omissions (E&O) insurance comes into play. In this blog post, we’ll explore what E&O insurance is, why it’s essential for disability insurance providers and how it can help safeguard your business from costly legal claims.

What is Errors and Omissions Insurance?

Errors and Omissions insurance, commonly known as E&O insurance, is a type of professional liability insurance that protects businesses and professionals against claims of negligence or inadequate work. In the context of disability insurance providers, this coverage helps shield you from claims arising from mistakes or omissions in the services you provide.

An E&O policy typically covers:

- Legal defense costs: Even if a claim is unfounded, defending yourself in court can be expensive.

- Settlements or judgments: If the court rules in favor of the client, the insurance may cover the settlement or damages.

- Related costs: Investigative expenses or mediation costs tied to resolving the dispute.

Why Do Disability Insurance Providers Need E&O Insurance?

Whether you’re a disability insurance agent or financial advisor, there are many ways a misunderstanding or error could lead to a lawsuit. For instance, a client might believe that you failed to disclose important policy details, or that you incorrectly processed a claim. In these situations, E&O insurance serves as your financial safety net, preventing a single mistake from threatening your livelihood.

Here are some key reasons why E&O insurance is essential for disability insurance providers:

- Complexity of Disability Insurance Policies

Disability insurance policies can be complicated, with many different terms, exclusions and stipulations. Misunderstandings can arise easily, especially if a client believes they were misinformed or misled about the coverage they purchased. - Human Error

Even the most experienced insurance professionals can make mistakes. An overlooked document, a misfiled claim, or a missed communication can lead to significant problems down the road. E&O insurance protects you from the financial repercussions of human errors. - Client Expectations

In today’s world, clients expect fast and flawless service. If there’s a delay or confusion regarding their policy, they might hold you responsible. E&O coverage helps ensure that you’re not left vulnerable to expensive legal claims if things don’t go as planned. - Litigation Costs: The cost of defending a lawsuit can be significant—even if you did nothing wrong. E&O insurance covers your legal expenses, so you can focus on your business instead of worrying about legal fees.

Common Scenarios Where E&O Insurance Applies

E&O insurance comes into play in a variety of situations, including:

- Claim Denial Disputes: A client may file a claim and find it denied due to specific policy exclusions. If they believe that you failed to properly explain those exclusions, they could sue you for negligence.

- Miscommunication: If a policyholder believes they were promised benefits that don’t exist in their policy, they may take legal action, accusing you of misrepresentation.

- Administrative Mistakes: A small error in processing an application or claim could lead to delays or denial of benefits, resulting in a lawsuit

How to Choose the Right E&O Policy

When selecting E&O insurance, it’s essential to tailor your coverage to the specific risks associated with disability insurance. Here are a few considerations:

- Coverage Limits: Ensure that the policy offers sufficient coverage for both defense costs and potential settlements. The right amount will depend on the size of your business and the value of the claims you handle.

- Industry-Specific Coverage: Make sure the policy covers the unique aspects of disability insurance, such as disputes over policy language or claim denials.

- Claims-Made vs. Occurrence Policies: Claims-made policies provide coverage only for claims made while the policy is active, while occurrence policies cover incidents that happen during the policy period, even if the claim is made later.

Protecting Your Reputation and Your Business

In the insurance industry, trust is everything. A single claim of negligence or misrepresentation can damage your reputation and lead to costly legal battles. E&O insurance provides an essential layer of protection, ensuring that your business remains financially stable even when things go wrong.

By investing in E&O insurance, you demonstrate to your clients that you take your responsibilities seriously. It reassures them that, should anything go wrong, you are prepared to make things right—without compromising their financial security or your business’s stability.

Final Thoughts

No matter how experienced or meticulous you are, mistakes can happen in the disability insurance business. E&O insurance gives you peace of mind, knowing that you’re covered if a client disputes your services. It’s a small price to pay for the protection it offers, allowing you to focus on what matters most: providing your clients with the best possible service.

In the end, E&O insurance is not just a safeguard for your business—it’s a commitment to maintaining the highest standards of professionalism and client care.

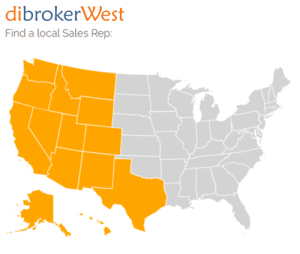

For more information about disability income insurance with mental nervous disorders, please call your local Regional Sales Reps for details!