Identifying New Disability Insurance Prospects

In sales, having a differentiator can be the key to success. We rely on product knowledge, streamlined processes and likable personalities to stand out from the competition. But in a crowded marketplace, where prospects are constantly bombarded with offers, finding a truly unique angle can make all the difference.

One of the most overlooked opportunities for differentiation is offering your clients income protection through Individual Disability Insurance (IDI). The vast majority of producers do not discuss or offer IDI, leaving a significant gap in their service. By making this a part of your conversation, you not only set yourself apart but also provide real value to your clients in a way most of your competitors don’t.

If you’re struggling to make inroads with a prospect or want to have a fresh, impactful conversation with an existing client, talk about IDI.

Two Types of Disability Insurance Prospects

There are two primary types of prospects when it comes to disability insurance: those who already own coverage and those who don’t.

1. Prospects Who Already Own Coverage

If your prospect already owns disability insurance, that’s a great start—it means they understand the need. However, there are still important questions to ask:

- Is their current coverage sufficient?

- Is it the right type of policy for their profession and income level?

- Are there gaps in their coverage that could leave them exposed?

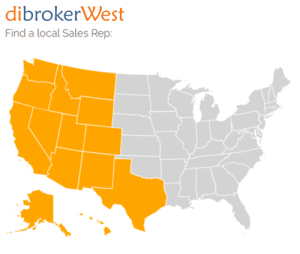

A DI specialist from dibrokerWest can help evaluate their existing policy to ensure they have the best protection in place. By offering to review their current plan, you position yourself as a trusted advisor rather than just another salesperson.

2. Prospects Without DI Coverage

For those who don’t yet own disability insurance, the conversation begins with a simple but powerful question: “What would happen to your income if you got sick or hurt and couldn’t work?”

This question is particularly effective for business owners, high-income professionals and anyone who relies on their paycheck to maintain their lifestyle. Most people insure their homes, cars and even their cell phones, but they often overlook protecting their most valuable asset—their ability to earn an income.

Why Disability Insurance is an Easy Conversation Starter

- It’s a real concern: People rarely think about what would happen financially if they were unable to work due to illness or injury.

- It’s highly relevant: Most people’s ability to earn an income is essential to supporting their families, businesses and lifestyles.

- It’s a differentiator: Since many producers do not bring up IDI, you gain an immediate edge by introducing a crucial, often-overlooked topic.

How to Take Action

If you’re ready to stand out and offer something that truly adds value to your clients, start talking about Individual Disability Insurance today. You don’t have to be an expert—dibrokerWest has the expertise and resources to support you. Partner with a DI specialist to ensure your clients get the protection they need while you set yourself apart from the competition.

Differentiate yourself. Help protect your clients’ most valuable asset. Talk IDI.

Until next time, stay ahead by offering what others don’t.