The Pros and Cons of Using Text Messaging for Business

In an increasingly digital and fast-paced world, communication methods are constantly evolving. One of the most prevalent forms of communication today is text messaging. Its use spans personal interactions to business transactions, including the sale of disability insurance. While there are numerous advantages to using text messaging for disability insurance sales, there are also notable drawbacks. Let’s delve into both sides of the coin.

What is Text Messaging

Text messaging, also known as SMS (Short Message Service), was introduced in the early 1990s and allowed sending and receiving short text messages between mobile phones. Texting was mostly used for personal business but its popularity in the business world quickly grew. More recently, many new texting applications have emerged, including Facebook Messenger, WhatsApp, Google Voice, WeChat, Discord and that’s just the tip of the iceberg.

Why do we mention this? Different platforms have different communication rules and policies – some of which may be different from texting for personal use. You should know which platforms you’re communicating through and the policies for businesses using that platform.

Should you Text Clients?

The short answer is yes, with caution. Texting with clients is convenient but it must be managed differently than texting your spouse or friends. Depending on your role and the nature of your business, there could be regulatory limitations governing text communication. At minimum, you must consider business etiquette when texting with clients. You must honor do not call lists and client unsubscribe requests.

TIP: we recommend using a text message service that manages opt in/out requests. Remembering who you can text and you can call gets complicated. Most texting services are accessible through your mobile device so it’s still convenient.

Pros of Using Text Messaging for Disability Insurance Sales

- Instant Communication: Text messaging allows for real-time communication with potential clients. This immediacy can speed up the sales process, enabling quick responses to inquiries and swift follow-ups on leads.

- High Open and Response Rates Text messages typically have a high open rate, with studies showing that 98% of SMS messages are read. This ensures that your message is likely to be seen and considered by the recipient.

- Convenience Many people prefer texting over phone calls or emails due to its convenience. Text messages can be read and responded to at any time, making it easier for clients to engage without disrupting their daily routines.

- Personal Touch Personalized text messages can create a more intimate and direct connection with clients. This can enhance the customer experience, making clients feel valued and understood.

- Cost-Effective Text messaging is generally more cost-effective compared to other communication channels like phone calls or direct mail. This can be particularly beneficial for smaller insurance agencies with limited marketing budgets.

Cons of Using Text Messaging for Disability Insurance Sales

- Limited Information Delivery Text messages have character limits, which can constrain the amount of information that can be conveyed. Explaining the complexities of disability insurance policies in a concise manner can be challenging.

- Lack of Formality The informal nature of text messaging may not always be suitable for discussing serious topics like disability insurance. Some clients might prefer more formal communication channels that convey professionalism.

- Privacy Concerns Text messaging involves sharing personal phone numbers, which can raise privacy concerns for clients. There is also the risk of sensitive information being intercepted if the messaging service is not secure.

- Regulatory Compliance There are stringent regulations governing electronic communications in the insurance industry. Ensuring compliance with regulations like the Telephone Consumer Protection Act (TCPA) and the Cellular Telecommunications Industry Association (CTIA) can be complex and may require additional resources.

- Miscommunication Risks The brevity of text messages can sometimes lead to miscommunication or misunderstandings. Without the nuances of voice tone or body language, it’s easier for messages to be misconstrued.

Conclusion

Text messaging offers a dynamic and efficient way to engage with clients in the disability insurance market. Its immediacy, high engagement rates, and cost-effectiveness make it an attractive tool for sales professionals. However, it also comes with challenges such as limited information delivery, privacy concerns, and regulatory hurdles. Balancing the use of text messaging with other communication channels can help mitigate these drawbacks while capitalizing on its strengths.

Incorporating text messaging into your sales strategy should be done thoughtfully, ensuring that it complements rather than replaces more traditional methods of communication. By doing so, you can enhance client interactions and improve overall sales performance in the disability insurance sector.

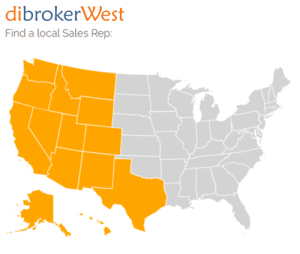

For more information about disability income insurance and using text messaging to grow your business, please call your local Regional Sales Reps for details!