Supreme Court Ruling Highlights Tax Implications for Buy-Sell Agreements

When business owners craft buy-sell agreements, one critical goal is ensuring a smooth transition of ownership in the event of an owner’s death. However, the Supreme Court’s June 2024 decision in Connelly v. United States (PDF) highlights how the structure of these agreements can have significant and unexpected tax consequences. For those relying on entity purchase agreements funded by life insurance, this ruling could result in substantial estate tax liabilities.

I recently attended an estate planning attorney peer networking group that focused on this ruling. The main takeaway is that any Buy Sell Agreement that is set up for ‘entity purchase’ may have a much larger tax liability than they realize. In the case, Michael Connelly owned 77% of the company. The buy sell plan was funded by the $3.5 million life insurance policy on each owner.

The Ruling: Life Insurance Proceeds Increase Estate Value

In Connelly v. United States, the Supreme Court ruled that life insurance proceeds used to fund an entity purchase buy-sell agreement must be included in the company’s value for federal estate tax purposes. This decision significantly affected the estate tax liability of the deceased owner.

In this specific case, the life insurance proceeds increased the company’s value by 77% of the payout—equivalent to the deceased owner’s ownership stake. This increase in the company’s value resulted in an estate tax liability exceeding $800,000. The Court’s decision underscores the importance of understanding how buy-sell agreements and their funding mechanisms interact with estate tax rules.

Types of Buy-Sell Agreements Affected

- Redemption-Type Buy-Sell Agreements: In these agreements, the company purchases life insurance on the lives of the shareholders. Upon a shareholder’s death, the company uses the insurance proceeds to buy the deceased shareholder’s shares.

- Entity Purchase Agreements: These agreements are similar in that the company—not individual shareholders—purchases the shares from the deceased’s estate using life insurance proceeds. The Connelly decision now requires these proceeds to be considered part of the company’s value for estate tax purposes.

What the Ruling Does Not Apply To

- Cross-Purchase Agreements: In these agreements, each business owner buys life insurance policies on the other owners. When one owner dies, the surviving owners use the proceeds to purchase the deceased owner’s shares. Because the proceeds are not paid to the company, they may avoid inclusion in the estate tax calculation.

Key Takeaways for Business Owners

The Connelly ruling has significant implications for business owners, particularly those of closely held businesses:

- Reevaluate Your Clients’ Buy-Sell Agreements: Advisors should review the structure of their business owner clients’ buy-sell agreements to assess potential tax consequences.

- Consider Alternative Structures: Cross-purchase agreements, for instance, may avoid the estate tax inclusion issue altogether.

- Consult with Experts: Estate planning attorneys, tax advisors and financial professionals can provide valuable insights into how your clients should optimize succession and estate plans.

- Understand the Tax Implications: Fully understanding the tax implications of your clients’ business succession plan is crucial. This includes considering how life insurance funding mechanisms may impact the valuation of your clients’ business for estate tax purposes.

Why This Matters

The Connelly ruling underscores the need for careful planning and regular review of buy-sell agreements. Many business owners might unknowingly expose their estates to higher tax liabilities due to the inclusion of life insurance proceeds in the company’s valuation. With proactive planning, however, these risks can be mitigated, ensuring that both the business and the estate are protected from unforeseen tax burdens.

By staying informed and seeking professional guidance, business owners can navigate the complexities of buy-sell agreements and ensure a seamless transition of ownership with minimized tax liabilities.

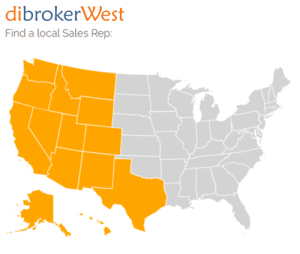

If you have questions about this Supreme Court ruling – or any disability income insurance questions, please call your local Regional Sales Reps!